Simon Property Group is nicely located to advantage from the US retail economic Property Stock system normalization in patron spending traits after the pandemic fades. That’s frequent feel for the nation’s greatest purchasing mall and retail house proprietor (on pinnacle of residences in Europe and Asia). An more raise that Wall Street is failing to take into account is rising inflation in America will assist the employer raise rents, whilst underlying actual property values climb quicker than usual. Owning actual property thru low interest-expense debt has been a outstanding wind at the return of REITs for a stable two years running, and is a leveraged thinking all buyers must reflect onconsideration on maintaining today. $11.70 in FFO projected for 2022 effortlessly covers a notable 6%+ dividend story, with a contemporary money payout of $6.80 annually. Combining the three foremost positives, and searching at a stock quote that nevertheless trades beneath its pre-pandemic level, earnings and defensive-minded traders might also advantage properly shopping for this REIT simply above $100 in late May.

Company Website

Company Website

Several weeks ago, the administration outlined the bullish outlook in their March Q1 profits release. According to Chairman and CEO David Simon,

Leasing momentum, retailer income and money float all accelerated. Given our accomplishments this quarter and our modern view for the the rest of 2022, nowadays, we raised our quarterly dividends and are growing our full-year 2022 guidance.

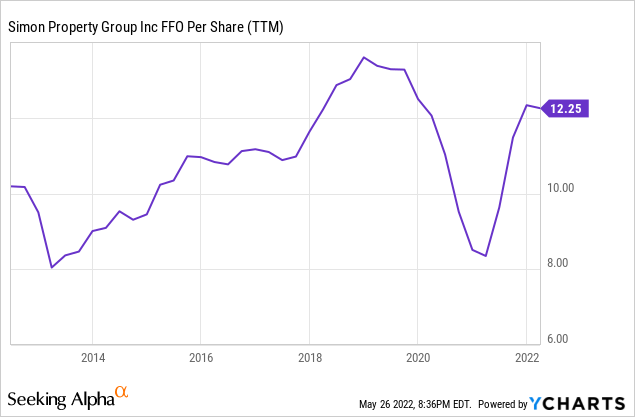

Simon Property’s board extended its quarterly dividend to $1.70 per share from $1.65 previously. Management enterprise may also purchase lower back up to $2 billion of its frequent inventory over time, wondering if its valuation is too low. I agree buying itself (at decrease accounting e book values) makes higher monetary experience than obtaining new residences at higher actual property prices. The employer now expects 2022 FFO per share of $11.60-$11.75 vs. prior coaching of $11.50-$11.70. FFO numbers have nevertheless no longer recovered definitely from the pandemic, as you can assess on the layout below. However, Wall Street estimates previous 2022 task regular boom on the horizon.

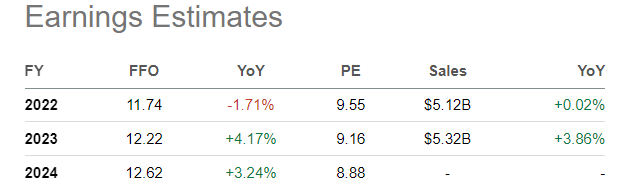

Analyst Estimates, Seeking Alpha Table – May 26, 2022

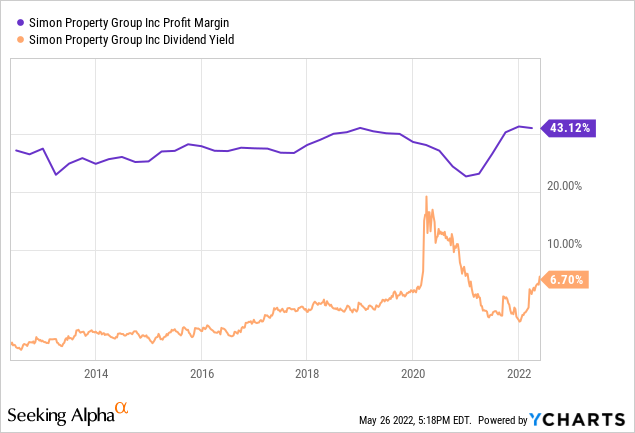

Compelling Valuation Story

I have no longer stated Simon as a bull notion over my years on Seeking Alpha. In fact, I have cautioned the organization as a keep or promote notion on the grounds that $180 a share in an article from December 2016 here. However, I am rapidly warming up to SPG as an funding proposition in the center of 2022. Rising actual property costs and enhancing margins, with a properly above-average dividend yield of 6%+ vs. the cutting-edge S&P five hundred charge of 1.4%, are getting difficult to omit in mixture for catalysts.

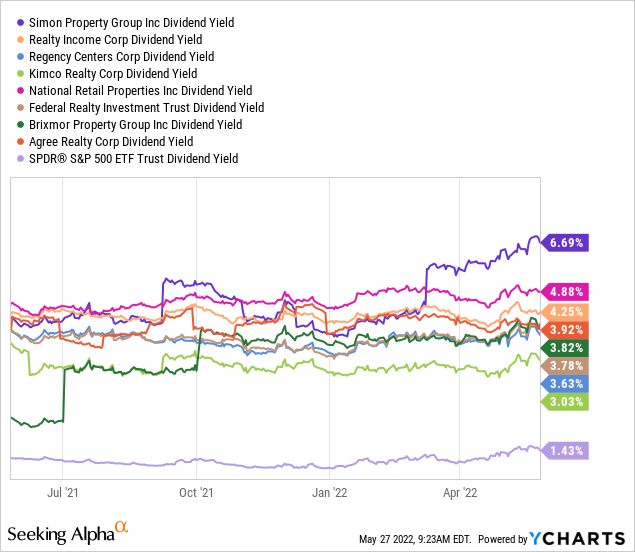

The dividend yield is additionally a pinnacle preference vs. friends and opponents in the retail leasing industry. Below is a 1-year diagram of trailing yield vs. Realty Income (O), Regency Centers (REG), Kimco Realty, National Retail Properties (NNN), Federal Realty (FRT), Brixmor Property (BRX), and Agree Realty (ADC).

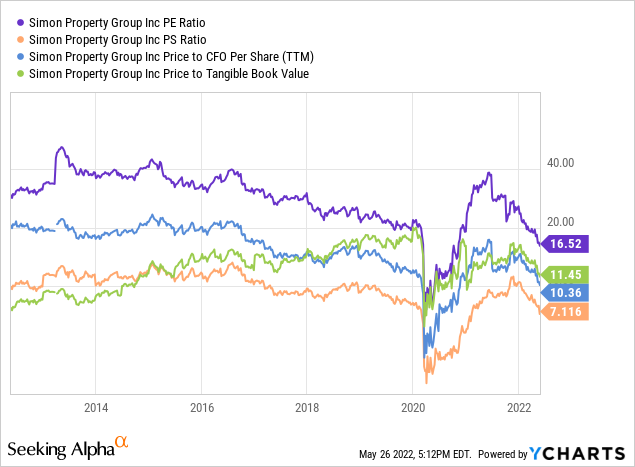

A range of different valuation stats are starting to argue in want of ownership. On primary ratios of charge to trailing earnings, sales, money flow, and tangible e book value, the REIT is buying and selling close to 10-year lows proper now, if you pass by the early 2022 pandemic investor dump on government-mandated retail closures.

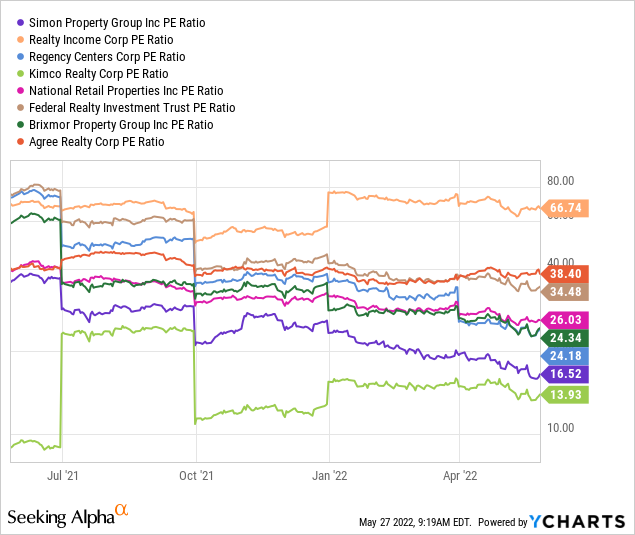

The cutting-edge P/E ratio (not FFO) is without a doubt one of the lowest numbers at 16x in the retail REIT space. The peer crew median common is nearer to 24x. Actual income is now masking the dividend distribution, a foremost plus in phrases of monetary strength.

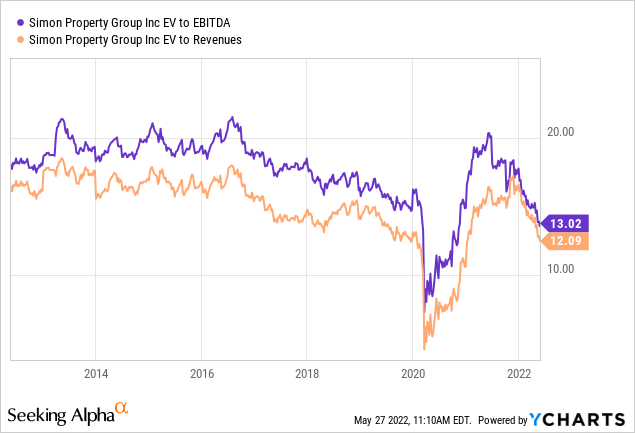

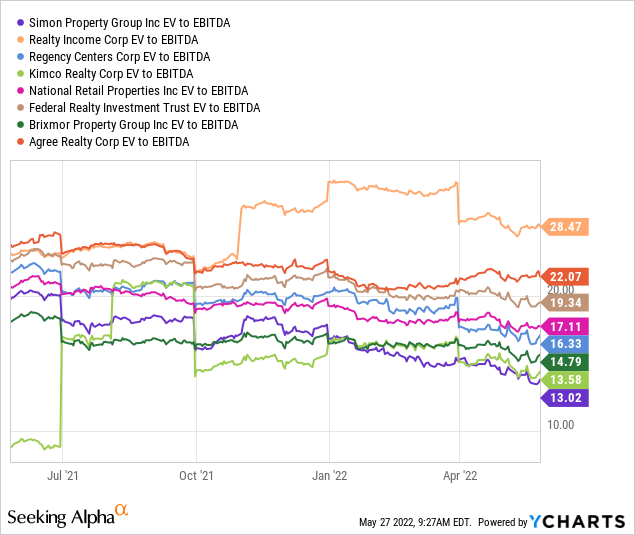

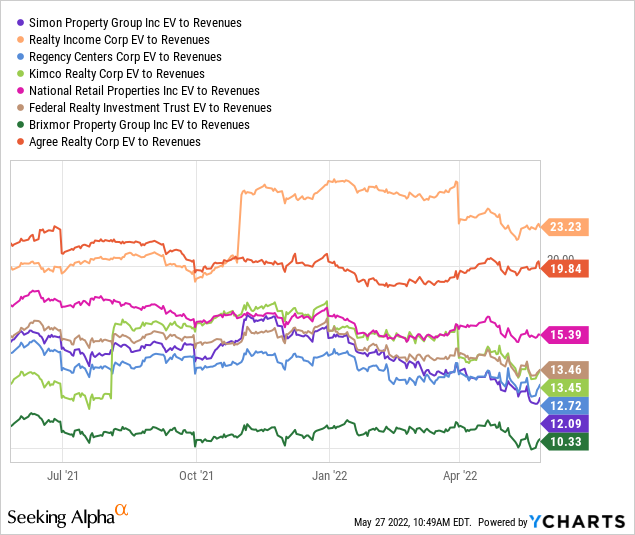

On agency valuations, including debt to fairness capitalization, Simon seems even cheaper. Below are graphs of the ratio EV on trailing (earnings earlier than interest, taxes, depreciation and amortization) and sales. Both are buying and selling at a top 30% cut price to 10-year averages. Historically, Simon’s EV to valuation has been set at a top rate range to the S&P five hundred index average. However, the modern 13x a couple of is a moderate cut price to the US blue-chip common equal around 15x.

Against the peer group, Simon’s EV to EBITDA is the lowest. And, EV to Revenues of 12x is a cut price on the peer median common of 13.5x.

YCharts

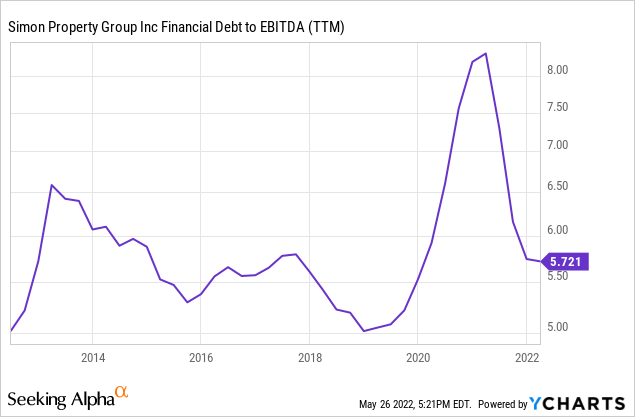

My largest subject over the years has been a greater than industry-normal leverage setup. The company’s giant dimension and geographic diversification has allowed for larger debt issuance, pushed with the aid of Wall Street firms. The downside has been the inventory has lagged for performance, with debt carrier taking its toll on flat income and client visitors traits at buying malls. Demographic retail income increase has been transferring towards on-line outfits like Amazon (AMZN) over time, specifically for the duration of the brick-and-mortar shutdowns pandemic.

Below is a layout of complete economic debt as a feature of money earnings, represented by way of EBITDA.

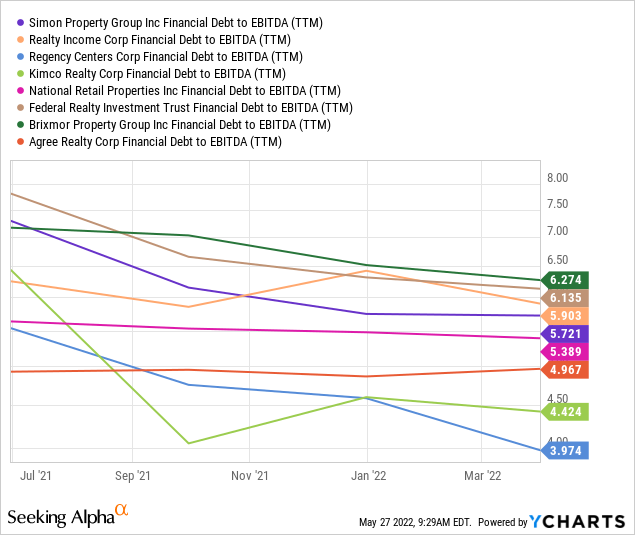

The modern leverage scenario is no longer tons worse than the peer group, pictured below. However, I would select this enterprise chief for rectangular pictures and fairness market capitalization decrease its debt totals to decorate flexibility throughout recessions and extend safety/defensive traits for long-term shareholders.

Limited Selling Pressure

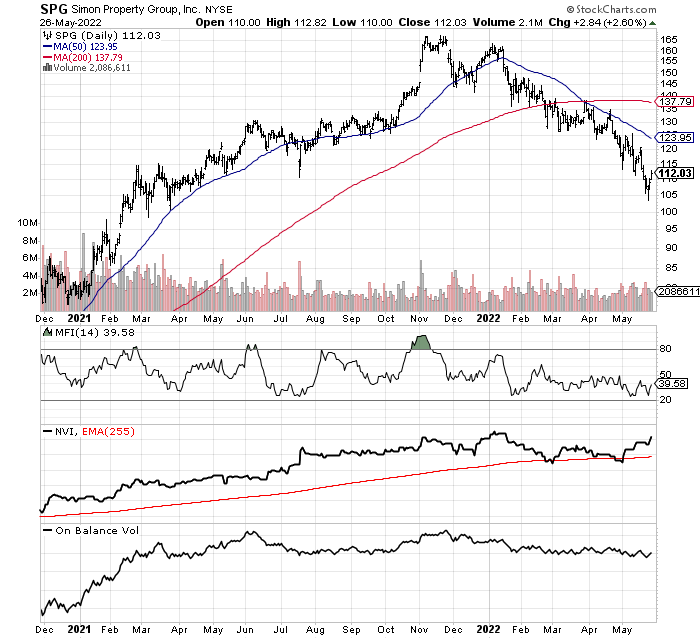

In my technical buying and selling research, the lack of aggressive promoting stands out in 2022. Sure, the share charge has declined a suitable 30% with the REIT area and market decline of a comparable share for the duration of the first 5 months of the year. Yet, proof of specific, incredible promoting strain in SPG does now not exist.

Reviewing an 18-month chart of each day changes, the 14-day Money Flow Index has now not reached severe levels, whilst the Negative Volume Index has truly remained in an uptrend. some other positive, On Balance Volume has failed to decline dramatically with price, signaling extent agents have now not been the problem.

The backside line is I anticipate Simon Property to lead any reversal in style to the upside for retail REITs. The query is when will such a turnaround materialize.

Final Thoughts

Simon should additionally advantage from the long-term push to generate cleaner, renewable energy. How? One of the extra modern thoughts is to use massive retail areas to put up photo voltaic panel farms, both on constructing rooftops or in parking lots. If Simon a decade from now generates a great component of wished electrical energy for company-owned buying malls, whilst promoting extra electricity lower back to nearby utilities, a superior cost proposition for renters and new income circulate from present residences may want to come to be fact in time.

What are the risks on funding in SPG? Two stands out to me. First, a weaker economic system and/or the return of the pandemic would without a doubt harm commercial enterprise increase trends. The Federal Reserve’s tightening cycle in early 2022 is slowing client demand for sure. Whether you seem at the -1.5% GDP contraction for the first quarter of the yr (adjusted for 40-year excessive inflation), or comply with the big affordability trouble in the domestic actual property market from spiking expenditures and the 2%+ leap in loan costs from ultimate spring, financial increase in 2022 will be feeble at best.

In addition to the odds mall buying traffic/spend will gradual with the aid of the quit of the year, scientific specialists are concerned about new COVID-19 lines will be round for a while. The Russian flu of 1889-94 that circulated round Europe for 5 years, besides a vaccine fix, has a variety of similarities to brand new novel coronavirus. I would now not be amazed with the aid of intermittent flareups, requiring social distancing and masks, till extra giant publicity and immunity develops in the world’s population.

A 2nd danger is administration will aggressively gather new residences and borrow at plenty greater activity fee than modern debt. The corporation nonetheless holds debt stages that make me nervous. A deep recession alongside an awful lot greater activity charges ought to squeeze earnings dramatically. Nevertheless, management’s focal point on cutting-edge properties, and choice to use extra money glide to purchase returned shares are stable thoughts in modern day financial environment. I would propose the corporation pay off higher-rate debt and journey out its low-interest fee leverage as lengthy as possible. 5%+ actual property inflation yearly with debt financed at the identical or decrease prices is a sturdy wealth constructing method for owners.

I am working on a design to buy a stake in Simon Property subsequent week. A small function now, with the opportunity of including on weak spot is the conflict plan. I have a fee goal of $120-$150 in 12-18 months. Nothing awesome for capital appreciation, however, the 6%+ dividend yield has to help define a complete return in the 15-20% annualized vary the subsequent a number of years. Outside of an inventory market crash or deep recession, I locate it challenging to mannequin a fee beneath $90. Real-world chance on any other promotes wave in US equities this fall have to be constrained to $95 or $100.